The streaming business is maturing. So are the viewers.

Americans age 50 and older are powering the growth of streaming video in the U.S., accounting for the biggest increase in time spent on services such as Netflix, NFLX 8.20%▲ Hulu and YouTube, according to data from measurement firm Nielsen.

People 50 and over accounted for 39% of streaming watch time as of May, up from 35% a year earlier, the data show. Overall streaming usage increased across the board, but the growth came disproportionately from older audiences and the share of viewing by every other age group decreased over that period. People ages 50 to 64 claimed a larger share of streaming time than those ages 35 to 49 for the first time, according to Nielsen.

Older people’s adoption of streaming services—from free, ad-supported services to subscription offerings—comes as more Gen X consumers and baby boomers part ways with their cable service.

“Streaming has progressed beyond both early adopters and the second wave, into older audiences that have been the last holdouts,” said Brian Fuhrer, senior vice president of product strategy and thought leadership at Nielsen.

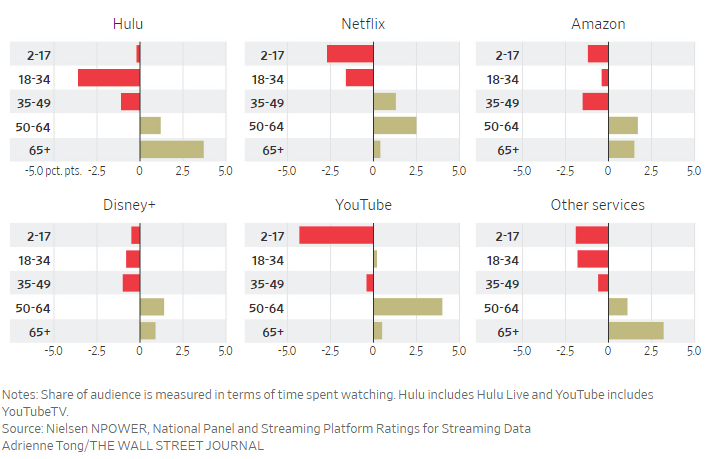

Aging Up

Share of audience in May 2022 by age group, change from a year earlier

The first waves of streaming growth in the past several years were driven by younger groups, who were the first to cut the cable cord. As the U.S. streaming market saturates—reflected in Netflix Inc.’s stagnating growth—drawing in older audiences has become important for established streaming platforms.

Once older viewers start streaming, they are more likely to browse and see what else they can watch, Mr. Fuhrer said, adding that older people tend to spend more time watching TV than younger people. There is now more content on streaming platforms that appeals to older viewers, such as the legal drama “The Lincoln Lawyer” and shows such as “Heartland” and “Outlander,” he said.

For some Americans aged 50-plus, dinner table chatter and Zoom calls during the pandemic with children and relatives piqued their interest in streaming. Many households that didn’t use streaming services before the pandemic began doing so when they were quarantining at home. That brought in a new base of users, particularly people 50 and over who previously watched cable TV, Mr. Fuhrer said.

Tim Avery, who is 51 and has had a Netflix account for a decade, cut the cord and added Hulu with live TV and Disney DIS 3.66%▲+ over the past two years. He and his wife just finished the latest season of “Stranger Things” and he also enjoys Marvel and Star Wars films on Disney+. While his new streaming habits aren’t much cheaper than his cable bill, “I like the flexibility of being able to watch anywhere on any device,” he said.

Netflix legal drama ‘The Lincoln Lawyer’ is one of the shows that appeals to older viewers.PHOTO: LARA SOLANKI/NETFLIX

Certain live sports events such as pro baseball games are now airing exclusively on streaming services, rather than cable networks, increasing the appeal of streaming and driving more fans to change their viewing habits.

The growth in streaming among people 50 and over “has gone hand-in-hand with easier access” to streaming services, including through smart TVs and connected set-top boxes, said Minal Modha, principal analyst and consumer research lead at London-based research firm Ampere Analysis.

Older viewers favor genres such as comedy, crime, thriller, action and adventure, according to Ampere, which tracks the selection of titles different streaming services offer and what consumers watch.

Keith Zubchevich, chief executive of streaming measurement and analytics firm Conviva, said there are still a lot of traditional TV viewers who could shift to streaming. For many people, TV proved inadequate during the pandemic and drove them to the bigger libraries and greater flexibility that streaming offers. “My mom is a binger,” he said.

Americans spent 24.5 billion minutes a day watching streaming content in May, up about 21% from a year earlier, according to Nielsen.

Netflix, with its 222 million subscribers, attracted the largest chunk of American viewing time in May, but its share rose only slightly to 6.8% from 6% a year earlier. Meanwhile, YouTube (including YouTube TV) was right behind Netflix with 6.7% of U.S. households’ TV time in May, up from 5.7% a year earlier.

Pablo Perez De Rosso, Netflix’s vice president of content strategy, planning and analysis, said the company has been anticipating increased competition for years.

“Now it’s a matter of in this new world how we continue to compete,” he said. The company is focused on making great content and growing internationally, he said.